Automated Textual Analyses

LMU Research Master

Photo by Adeolu Eletu on Unsplash

Photo by Adeolu Eletu on Unsplash

Ressources

Course Description

The course is aimed at doctoral students and teaches current textual analysis methods used in Accounting, Management, and Finance research. It introduces a framework and a tool set which enables researchers to measure previously hard to measure latent concepts using text data.

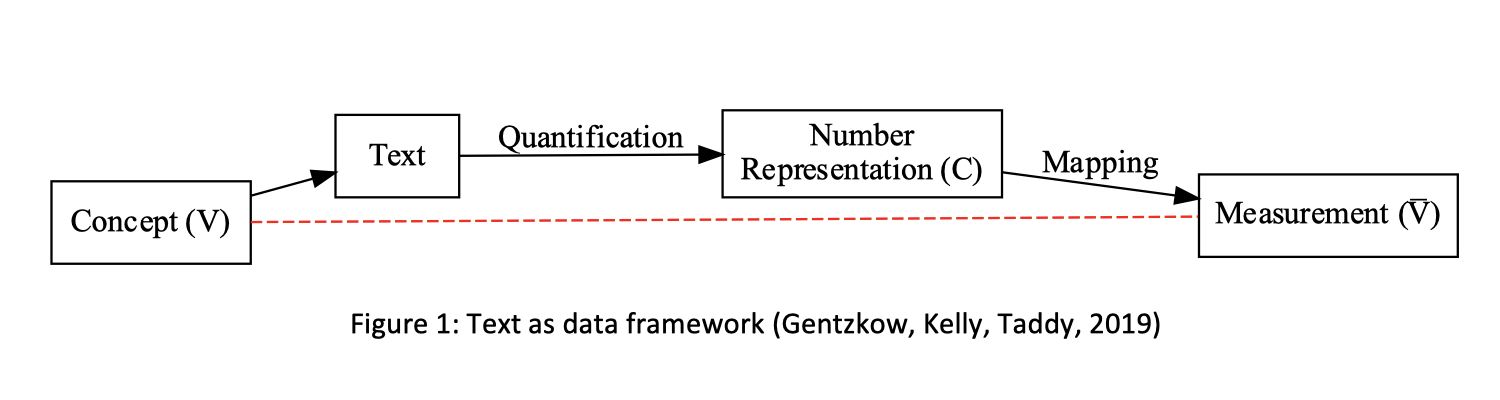

The course is roughly divided into three pieces of unequal length. The first piece is an introduction to the python programming language for the purposes of textual analysis. The other two pieces divide textual analysis into two connected steps: quantification and mapping

Quantification concerns quantifying text into machine readable form, such as the bag-of-words representation. Mapping encompasses methods, such as word-lists, supervised, or unsupervised methods, that turn numerical representations into the measure of interest.

Participants will be introduced to commonly applied approaches for both steps and will learn to reason about which approaches are advisable given the text at the hand and the concept to be measured. We will see multiple examples of how the concept to be measured influences certain texts and suggests particular quantification and mapping steps.

Learning Goals

Upon successful completion of this course, you will be able to:

- Decompose firm value into value drivers and evaluate a firm’s performance based on its value drivers.

- Evaluate a firm’s business model as to where its competitive (dis)advantages are.

- Analyze and evaluate a company’s current performance using financial statement information. (This includes detecting and adjusting for managerial or other distortions of financial information.)

- Analyze which information one needs to collect to evaluate a company’s future performance and how to critically analyze this information.

- Build and defend forecasts of a company’s future performance using state-of-the-art analytical frameworks.

- Conduct and defend a full company valuation employing commonly used security valuation methods.